We've Gathered Some Frequently Asked Questions

Looking for something specific? Consider choosing a topic below.

Have something that you can't find the answer to here? Ask us directly.

Have something that you can't find the answer to here? Ask us directly.

Do I need to establish separate login credentials to access Treasury Management from a computer and the mobile app?

No; after you log in for the first time, your login credentials will be the same on both platforms.

I received a password reset email this morning, and this afternoon the link doesn’t work; why?

The password reset email is only valid for 2 hours.

What is the difference between a Super User, an Admin, and a User?

Administrators have access to the user settings, including adding, editing, deleting, and approving company users in Treasury Management. Administrators also have the ability to set entitlements and limits for all users, increasing the security of the platform. They also have the ability to restrict login access based on IP address and time of day.

Super Users have access to all accounts and transactional permissions enabled for the company.

In order for a user to have access to user settings and all transactional functions, the user should be set up as both an “Admin” and a “Super User.”

Users are provided entitlements to perform certain actions (such as ACH, Wires, etc.) by Admins.

I am a user for multiple businesses; how can I easily see which accounts apply to each business?

Users have the ability to group accounts in the Accounts tile in Treasury Management.

How can I easily access the features I use all the time?

The Treasury Management dashboard is customizable; you can re-arrange the tiles to put the features you use the most front and center.

Can I organize my accounts?

In the Accounts screen, you’ll see your accounts organized by Deposits, Loans, and Time Deposits. This order cannot be changed.

How can I quickly find a transaction?

Use the Transaction Search feature to quickly search for transactions based on specific criteria.

How do I see Reports?

Select Reporting > All reports. You will be able to customize reports to suit your needs.

What is Jack Henry, and why do I see it referenced in certain URLs?

Jack Henry is our core service provider for Treasury Management. You may see the name referenced in certain areas within Treasury Management.

What is a Company ID?

The Company ID is the specific code that Tompkins and Treasury Management use to identify your company. Users need this code to log in to Treasury Management. This code was provided to your business administrator.

I’m an Administrator; how do I reset a user’s password?

Admins must use the Manual Password Reset option to reset users.

Why weren’t the changes I made to the users saved?

You need to Save the changes you make to a user’s profile, and then Submit those changes for them to process. The “SUBMIT” button will appear in the top right corner after the changes are saved.

Why can’t I give nicknames to the accounts I have access to?

Account nicknames can only be managed by the Administrator.

Where do I find transaction cutoff times?

Cutoff times are listed in the Dashboard.

How do I view previous transactions?

Click on the account number from the dashboard to see “Today” transactions. Click the Menu option to see additional transaction history options. Selecting “Details” from the dashboard will provide you with 10 days of history. Visiting Accounts > Account list will also provide you with multiple transaction history options.

Can I send a message to Tompkins in Treasury Management?

Yes, you can communicate with our Customer Care Center with secure messages by using the Message Center.

Something doesn’t look right with how Treasury Management is displaying – why?

Some internet browsers cause Treasury Management to display differently than others. We recommend downloading the latest version of Chrome for the best and most secure experience.

What is Out of Band Authentication?

Out of Band Authentication is an additional security feature in place for your protection. Often, it is more commonly known as multi-factor authentication. All users with ACH and wire origination capabilities will utilize this authentication process when performing certain actions. You will choose either text message or phone call authentication when setting up your initial profile.

- For text message users, you will receive a text message at origination with a randomly generated code. Simply enter the code on your screen within Treasury Management to proceed.

- For phone call users, you will receive a phone call at origination with a randomly generated code. Simply enter the code on your screen within Treasury Management to proceed.

- Please note, email is not an authentication options.

If you are an administrator, you will also need to follow this process each time you set up or modify a user.

Why do I receive a text or phone call each time I originate an ACH transaction?

This is called Out of Band Authentication, and is an additional security feature in place for your protection. All users with ACH origination capabilities will be required to establish a 4-digit PIN, which will be required to verify each origination via text or phone call. You will establish your PIN the first time you log in.

- If you choose text: You will receive a text message at origination with a randomly generated code. You will need to reply to that text message with the randomly generated code plus your PIN to complete your authentication.

- If you choose phone call: You will receive a phone call at origination. You will be required to enter your 4-digit PIN to complete your authentication.

- Email is not an option to receive the code.

My ACH transaction appeared to process, but the recipient never received payment – why?

Please pay careful attention to the Message Center regarding your ACH transactions. If your ACH file fails due to incorrect or incomplete information, you will receive an error on your screen. If for some reason the file fails at the time it is scheduled to be originated, you will receive a notification in the Message Center within Treasury Management at that time. You may also set up an alert to receive this information by email or text.

How do I know what my ACH limits are for Payroll, Payments, etc.?

In Treasury Management, these limits are combined for one total limit. If the file you are uploading exceeds your combined limit, you will not be able to upload your file without requesting an increase from the bank.

What are Templates?

Templates are payee records/transactions that can be established for recurring use. Email addresses cannot be included as part of the payee ACH record.

Why am I having trouble submitting an ACH?

If you are uploading a file, there are several possible reasons:

- If an uploaded file contains an error (extra spaces, blank beneficiary name, etc.), it will be rejected and the file will need to be corrected and uploaded again.

- The ACH file name cannot be more than 50 characters.

- Users will need to enter an offsetting entry to balance all ACH batches. You’ll need to enter a final line item that includes the bank’s routing number, your account number, a credit (CR) or debit (DR) indicator, and the total amount of the batch. To easily enter the offsetting account each time you originate an ACH, you may create a “recipient” to be used as the offsetting account.

Where can I see my ACH payments?

Go to Payments > ACH Payment Activity to view all ACH history on the account.

What is the cutoff time for ACH processing?

There are two processing cutoff times for ACH transactions: 12 noon, and 3pm. Please note: Payments submitted before 12 noon may not be edited after the noon processing has taken place.

How do I split a transaction?

To split transactions in Treasury Management, two separate records must be created. For example, if a payroll record directs $50 to an employee’s Savings account and the remaining pay to their Checking account each week in our previous system, these transactions will be separate records in Treasury Management.

What is the cutoff time for Wires?

The cutoff time for submitting Wires in Treasury Management is 4:00pm. Users will not be able to initiate International (FX) wires after the cutoff time. Start time for initiating FX wires is 8:00am each business day.

I updated my phone number in my profile, but now I am not receiving the call/text for the Out of Band Authentication – why?

To update your Out of Band Authentication contact number(s), please log in to your Treasury Management profile, click on the Message Center, and send us a secure message requesting a reset. Once your profile is reset, you will be prompted at your next login attempt to update your Out of Band contact number(s).

What is a Template?

In Treasury Management, you can save beneficiaries as Templates for future use. The names of these templates will be the names of the beneficiaries. It is not possible for an email address to be included as part of the payee record.

When creating USD Wire, where will I be asked for the amount?

When creating a Wire from a template, you will need to select Initiate before entering the wire amount.

Why do I receive a text or phone call each time I originate a Wire?

This is called Out of Band Authentication, and is an additional security feature in place for your protection. All users with Wire origination capabilities will be required to establish a 4-digit PIN, which will be required to verify each origination via text or phone call. You will establish your PIN the first time you log in.

- If you choose text: You will receive a text message at origination with a randomly generated code. You will need to reply to that text message with the randomly generated code plus your PIN to complete your authentication.

- If you choose phone call: You will receive a phone call at origination. You will be required to enter your 4-digit PIN to complete your authentication.

- Email is not an option to receive the code.

If I frequently need to perform similar Wire transactions, can I automate them in Treasury Management?

Treasury Management allows users to perform recurring wires and create templates for future use. You will need to edit the template to select the appropriate funding account.

What do the labels “USD” and “FX” refer to?

Domestic Wires are referred to as USD Wires in Treasury Management, and International Wires are referred to as FX Wires.

How do I quickly see my EDI reports?

You can save EDI reports to your dashboard.

Can I upload one check issue file for multiple accounts?

When uploading a check issue file into Treasury Management, the system will assume all issued items within that file belong to the same account. You will need to create separate files for each account.

How do I make corrections to my Positive Pay Exception item?

You will need to compose a message in the Message Center with the details of what needs to be corrected.

How do I access reports?

Reporting capabilities are not currently available in Treasury Management, but are available through your current NetTeller portal.

What is Remote Deposit?

With Remote Deposit your business can scan and submit your check deposits electronically from the convenience of your place of business.

Do I Need to Buy Hardware to Use Remote Deposit?

There is no software to install, no computers to upgrade, and no PC to dedicate exclusively. All you need is a Windows PC with a high speed Internet connection, Microsoft Internet Explorer browser and the check scanner that we provide.

What Type of Computer Do I need?

Minimum system requirements are a computer running Microsoft Windows 10 with Internet Explorer 11 or later, a high speed Internet connection, and an available USB port for the scanner we provide.

Do I Need to Endorse the Back of Each Check?

No, the system will create a Virtual endorsement.

How Long Do I Keep the Checks?

Good practice would be to store the original checks in a secure location until you receive your bank statement that shows the deposit and then shred them within 30 days.

Do I Need to Prepare a Deposit Ticket?

No. Our software will create an image of a deposit ticket for each deposit you make, and the image will be included on the checking account statement we mail you each month.

Can I Import Deposit Information Into Other Software?

Yes. Detailed information for each check in each deposit can be exported as a comma delimited file, with optional fields for customer numbers, invoice numbers, etc. The file can then be imported into any application software for automated reconciliation.

My checks double-up (piggyback) during scanning. How do I address this?

Piggybacking can happen when 2 checks stick together, when a much larger check is paired with a smaller one in a stack, or if a check has perforated edges, etc. You can curb and address this by entering accurate check batch totals before scanning, then using Batch Edit to make corrections. On Scan, press Start to create a batch. Enter the total dollar amount of your check batch in the Expected Batch total field. Scan your checks, Close Batch. Go to Batch Edit. Here, your totals are displayed. Make your corrections, Save, or Delete checks that have Piggybacked. You can re-open your batch from Scan Start (arrow)> Open Batch, to rescan problem checks (Close Batch, Batch Edit). Then, you can Make Deposit.

Can I share a computer and scanner with someone, or scan for more than one business?

Yes; however, it is important that you Logout of Treasury Management and your Smart Pay Dashboard between sessions.

Who do I contact if I need a password reset or when I’m locked out?

For security, instead of emailing you’ll either request a reset from your Treasury Management Administrator, or call the number on your scanner: (888) 266-7441

Why Should I Use Remote Deposit?

The service allows for faster deposits, more efficient collections, and tremendous convenience for you and your employees.

How Does Remote Deposit Work?

You accept check payments from your customers and simply scan and submit those checks securely over the Internet to Tompkins Bank. We process your deposit as we would with physical checks.

Are My Deposits Available to Me Faster?

You can deposit as often as you like. Deposits made before 6pm (except for weekends and holidays) are credited to your account the next business day, subject to our normal funds availability policy.

Do I Need to Make a Copy of Each Check?

No. Once a check is scanned, you retain the original, for up to 30 days. A detailed report lists each check in the deposit, along with all of the information about the check.

What if a Check is Returned for Insufficient Funds?

We will return the image of the check to you in the mail, just the same as any paper check that is returned unpaid.

How Do I know if the Bank Has Received My Deposit?

When we process your deposit, a report will be generated, and available on your report list. You will see the deposit posted to your checking account the next business day when you sign onto Digital Banking.

While scanning checks I got interrupted and the screen timed out. Can I go back to my work?

While scanning, if you need to step away or handle an interruption you will need to select Close Batch to save your work. You can then choose Open Batch from the Start menu to continue where you left off.

What happens if the deposit amount I enter does not match the total amount of the scanned deposit?

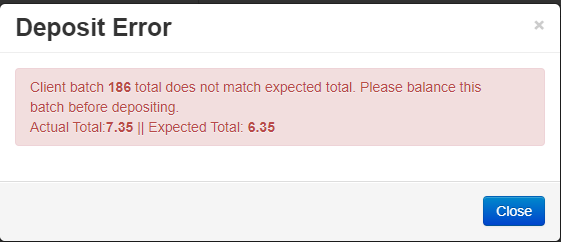

If the Expected Total you entered does not match the Actual Total amount of checks scanned, when you click on Make Deposit, you will receive an error message:

- Click close.

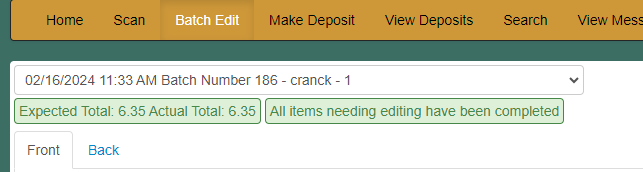

- Return to Batch Edit. Compare your physical checks to the scanned images and verify that all scanned amounts in your batch are correct. Correct any incorrectly scanned amounts and save after each one. Once you have corrected your check amounts, if your Expected Total matches your Actual Total, you will see two green boxes at the top of the screen and you can Make Deposit as normal:

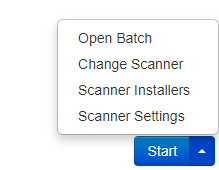

- If, after verifying that your check amounts are correct, you are still out of balance, you may have entered the Expected Total incorrectly. Return to the Scan page, then click the arrow next to the Start Button and select Open Batch:

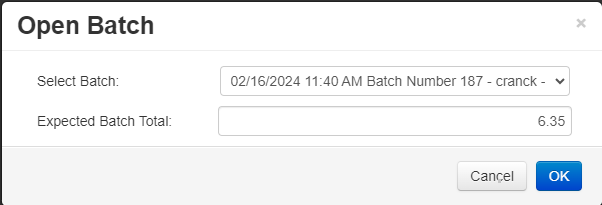

Select your Batch from the list of batches, and enter the correct amount for the Expected Batch Total, then click ok.

Close your Batch. You can now make your deposit.

How can I request to temporarily or permanently raise my deposit limits?

We can accept a secure request through the Treasury Management Message Center if you need a temporary increase. Your Tompkins Cash Management representative or branch can assist you with something permanent.

Why should I use Escrow Manager?

Escrow Manager is a comprehensive service that eases the burden of managing escrow funds by allowing you to deposit funds into a single "master" checking account with Individual escrow "sub-accounts" maintained by the bank.

This eliminates the need to open numerous accounts for each individual escrow deposit and allows you to write checks out of a single "master" checking account.

Is IRS reporting provided?

Yes, all IRS reporting and 1099-INT forms will be mailed directly to your clients by the bank.

Do you have detailed instructions on how to open the escrow sub-accounts, make deposits into a sub-account, disburse funds out of a sub-account?

TO OPEN A NEW SUB-ACCOUNT

- Deposit the funds into your Escrow Manager Master Checking Account, using a regular business checking deposit ticket or through Remote Deposit.

- Complete the Escrow Manager New Sub-Account Setup Form

Attach a scanned copy of your client’s W-9 form*

If you are unable to scan, please mail the W-9 form to

Deposit Escrow Management Department Box 31

P.O. Box 460

Ithaca, NY 14851

*Please note: the sub-account will not be opened until we receive a completed W-9 form for each new sub-account requested. This does not apply to IOLA accounts. - You will receive a confirmation email for each Sub-Account Transaction Form processed.

TO DEPOSIT ADDITIONAL FUNDS INTO AN EXISTING SUB-ACCOUNT

- Deposit the funds into your Escrow Manager Master Checking Account.

- Complete the Escrow Manager Sub-Account Deposit Form.

- You will receive a confirmation for each Sub-Account Deposit form submitted.

TO DISBURSE FUNDS FROM A SUB-ACCOUNT TO THE ESCROW MANAGER MASTER CHECKING ACCOUNT

- Contact our Deposit Escrow Management Department at 1-855-848-8696

- Write a check from the Escrow Manager Master Checking account to disburse the funds.

If you have any questions related to your Escrow Manager accounts please contact our Deposit Escrow Management Department at 1-855-848-8696.

Who do I contact if I have questions or need assistance with Escrow Manager?

Please contact the Deposit Escrow Management Department at 1-855-848-8696

Is there simplified reporting with Escrow Manager?

Yes, you will receive a monthly statement, listing all of the activity on the Escrow Manager Master Checking account and a comprehensive, consolidated monthly report that lists all sub-accounts and detailed transaction activity, balance and interest for each account.

This reduces a great deal of paperwork, assists with accounting and provides a detailed audit trail.

How do I enroll in Escrow Manager?

Just visit your local branch to open the Escrow Manager Master Checking account. You will receive a copy of the Escrow Manager Account Additional Terms, which outlines how the service works and your responsibilities.

How do I close a sub-account?

Follow the same procedure for dispersing funds, but indicate that the sub-account is to be closed on the Sub-Account Transaction form.

Why don’t I see my company’s eStatements?

Administrators need to provide users with access to eStatements. This can be accomplished by going to the Admin section, selecting the user > Actions > Edit User; scroll down to Integrated Services – Entitlements > Select Electronic Documents.

Where are my eStatements?

eStatements are in the Reporting section: Electronic Documents > eStatements/notices.

How do I set up eStatements for each account?

Reporting > Electronic Documents > Signup/Changes > select accounts > save changes.

IMPORTANT TERMS AND CONDITIONS FOR OVERDRAFT COURTESY

An overdraft item fee of $38 is charged each time we cover an overdraft that results in a negative end-of-day available balance.

An overdraft item fee of $38 is charged each time we cover an overdraft that results in a negative end-of-day available balance.

Overdrafts may be created by check, recurring payment, transfer, withdrawal, Debit or ATM Bankcard transaction, or other electronic means.

Once an overdraft has occurred, you must bring your account to a positive balance within thirty (30) days for a minimum of 24 hours.

Whether your overdraft will be paid is at Tompkins Community Bank’s discretion, and we reserve the right not to pay. For example, we typically do not pay overdrafts if:

- You do not bring your account to a positive balance within every thirty (30) day period for a minimum of 24 hours

- You are in default on any loan or other obligation to Tompkins Community Bank

- You are subject to any legal or administrative order or levy

- Your use of the Overdraft Courtesy has been excessive or abusive

What is Overdraft Courtesy?

Overdraft Courtesy is a service that we offer for times when you may inadvertently overdraw your account. We will have the discretion to pay the overdraft, subject to the limit of your Overdraft Courtesy and the amount of the overdraft fee. Overdraft Courtesy is not a line of credit. Read the Discretionary Overdraft Courtesy Disclosure for more details.

Do overdraft fees count against the Overdraft Courtesy amount above?

Yes, any and all fees and charges, including without limitation the non-sufficient funds fees (as set forth in our fee schedules and deposit account agreement and disclosure), will be included as part of this maximum amount. It may be possible that your account will become overdrawn in excess of the Overdraft Courtesy amount as a result of the assessment of a fee.

What is an everyday debit card transaction?

It’s a one-time, non-recurring purchase. It is not a recurring payment that you’ve set up to charge automatically to your debit card, such as a monthly payment for a gym membership.

Can I be charged more than one overdraft fee per day?

Yes, you will be charged an overdraft fee for each item that creates an overdraft on your account. For example, if you have an available balance of $20, and you have three items presented to your account on the same day for $30 each, you will be charged three overdraft fees.

How does the bank’s check clearing policy impact overdraft fees?

Transactions may not be processed in the order in which they occurred, and the order in which transactions are received and processed may impact the total amount of fees incurred.

If I don’t Opt-In to Overdraft Courtesy for everyday Debit Card and ATM transactions, will you continue to approve other transactions?

Opting-In pertains to everyday debit card and ATM transactions covered by a bank’s standard overdraft practices such as Overdraft Courtesy. If you do not Opt-In, we may continue to extend Overdraft Courtesy to cover your checks, transfers and recurring payments.

We have a joint account and we each have debit cards. Do we both need to Opt-In to Overdraft Courtesy for everyday Debit Card and ATM transactions?

No, either one of you can Opt-In to give authorization for the joint account and either of you can revoke the Opt-In for the account at a later time. We will use the most recent instructions on file.

Do I need to Opt-In to Overdraft Courtesy if I have Savings Overdraft Protection or an Overdraft Line of Credit?

Overdraft Courtesy may supplement your overdraft protection services:

Both Savings Overdraft Protection and an Overdraft Line of Credit are overdraft protection services to prevent overdrafts. When there aren’t enough funds available in your checking account to cover a transaction, funds are transferred from your savings account or credit line to prevent an overdraft, and there is a $10 transfer fee per transfer. If you Opt-In and there aren’t enough funds in your savings account or Overdraft Line of Credit to cover the transaction, we may, at our discretion, extend Overdraft Courtesy to pay it, and our standard $38 overdraft fee per item would be charged. If we don’t have your Opt-In on file, we will no longer be able to extend Overdraft Courtesy to approve an everyday debit card or ATM transaction when you don’t have enough funds available in checking, Savings Overdraft Protection, or an Overdraft Line of Credit to cover it. Regretfully, your transaction will be declined.

What is the amount of Overdraft Courtesy on my account, if applicable?

The Courtesy for consumer checking accounts will generally be limited to a maximum $700 overdraft (negative) balance. This Courtesy for commercial accounts will generally be limited to a maximum $1,000 overdraft (negative) balance.

If I Opt-In to Overdraft Courtesy for everyday Debit Card and ATM transactions, will my transactions always be paid?

Payment of an overdraft is at our discretion, and the amount of Overdraft Courtesy we may extend is based on your account history. We reserve the right not to pay an overdraft; for example, if the account is not in good standing, if deposits are not being made regularly, or if there have been excessive overdrafts.

Are there fees for Overdraft Courtesy?

There is no cost to keep Overdraft Courtesy in place on your account as a safety net. If you use the protection and we advance funds to cover your transaction, our standard overdraft item fee of $38 will be charged to your account.

Is there a limit on the number of overdraft fees I may be charged in one day?

Yes, for consumer accounts there is a daily limit of 6 overdraft fees per day we can charge you for overdrawing your account. There is no daily limit for business accounts.

When do I need to repay an overdraft?

An overdraft should be repaid promptly, but you must bring your account to a positive balance within thirty (30) days for a minimum of 24 hours.

What if I Opt-In to Overdraft Courtesy for everyday Debit Card and ATM transactions now and change my mind later?

You can always change your mind and revoke your Opt-In at any time at your branch, by calling 1-888-273-3210, or by visiting www.tompkinstrust.com/revoke or by printing and mailing the completed revocation form to:

Deposit Operations

PO Box 460

Ithaca, NY 14851

PO Box 460

Ithaca, NY 14851

I have more than one checking account. Does my Opt-In to Overdraft Courtesy for everyday Debit Card and ATM transactions cover all my accounts?

No, the regulation requires that an Opt-In be on file for each account.

What other overdraft protection services do you offer?

We offer two overdraft protection plan alternatives for checking accounts. The first is an Overdraft Protection Line of Credit – funds are transferred from your available credit line to prevent an overdraft in checking (requires credit approval). The second is Savings Overdraft Protection – funds are transferred from your linked savings account to prevent an overdraft in checking. Transfer fees apply for both services. Ask for details.

Can I use the Bill Pay system to pay my bills?

Yes; you also have the ability to set limits for other users, and to enable dual authorization.

How do I establish Principal Only loan payments?

You can create a Principal Only payment by selecting Create a Loan Payment. You will have the option to future date this payment, but these payments cannot be made to recur. If you wish to complete Principal Only payments on a regular basis, you will need to manually create them by following these instructions.

Where can I review the Terms and Conditions?

Review all of our disclosures as well as our schedule of fees.

Can I make a transfer to more than one account at a time?

Yes – in Treasury Management, transfers can be done one to one, one to many, or many to one. You can also create transfer Templates for future use.

What is an External Account?

This feature allows you to link Checking, Savings or Loan accounts with other financial institutions to your Online Banking account. Once you have successfully linked your external accounts, they will appear in the transfer drop down menu.

How do I add an External Account?

Just follow these simple steps. You must have an active Retail Online Banking account (Business Internet Banking customers must use the provided ACH Cash Management functions to be in compliance with NACHA authorization requirements):

- Log in to your Online Banking Account

- Click on “Transfer”

- Click on “Recipients”

- Click “Add a Recipient”

- Choose “An account at another bank or credit union”

- Choose “Continue to form”

- Print the form using your browser’s print function and complete and sign section

- Return your completed and signed form to us either by US Postal Service, fax or dropping off at your local branch

When will my successfully scheduled external transfers be posted?

Outbound Transfers are effective on the later of (i) the next banking day after the Transfer Date (as shown on the Transfer screen), or (ii) such future date as You may have indicated in your Transfer request. The external account will be credited according to the receiving bank’s availability and transaction processing schedule. The cut off time for submitting a Transfer for same day processing is 3:00 p.m. ET each business day.

Inbound Transfers will be credited to your account on the day the Transfer is effective, and the funds may be subject to holds based on our Funds Availability Policy. Your external account will be debited according to the transactions processing schedule of the other financial institution.

How much can I transfer using this service?

Review Electronic Funds Transfer disclosure for any external transfer limit restrictions.